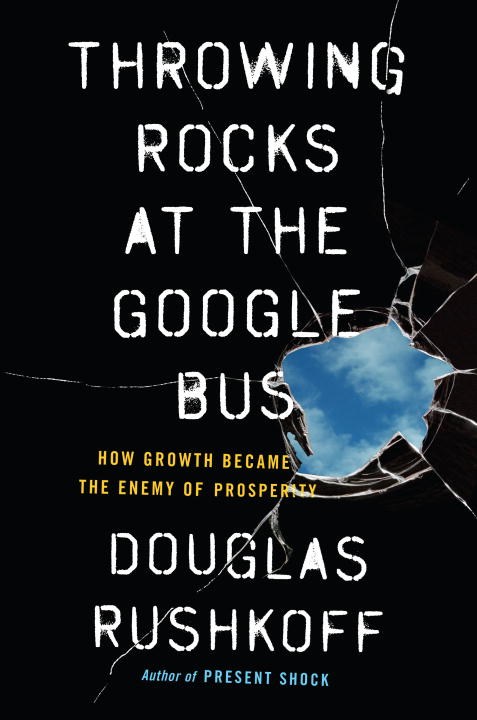

Throwing Rocks at the Google Bus: How Growth Became the Enemy of Prosperity

March 03, 2016

Douglas Rushkoff, in his usual expansive and incredibly erudite manner, dissects the digital economy and points a more considered way forward.

Throwing Rocks at the Google Bus: How Growth Became the Enemy of Prosperity by Douglas Rushkoff, Portfolio, 288 pages, $28.00, Hardcover, March 2016, ISBN 9781617230172

The Internet was going to change everything for the better. It was going to democratize and flatten the world, putting everyone on the same virtual playing field regardless of race, gender, or creed. It was going to transform our politics and businesses for the better. Neither our businesses nor our politics have lived up to that utopian vision. In many cases, things have gotten steadily worse.

In response, we’ve seen a flood of books recently with titles like The Internet Is Not the Answer, The Rise of the Robots, Humans Need Not Apply, and The Glass Cage that are shining a bright light exposing the negative societal effects of the Internet and automation. (That’s to say nothing of what it’s doing to us as individuals—how it is changing how we think, concentrate, and go about our work and private lives, seen in books like The Shallows and Deep Work.)

Douglas Rushkoff shares points of concern with all of these in his new book, Throwing Rocks at the Google Bus, but he isn’t quite ready to give up on the utopian (or at least more egalitarian) prospects of the digital age. The book takes its name from the protests that sprouted in San Francisco in response to the private busses that shuttle Google employees from their homes in the rapidly gentrifying neighborhoods of San Francisco to its headquarters in Mountain View every day. When protestors were simply lying down in the street to block the bus, Rushkoff found himself in silent, smiling support of the issue being raised. He had an abiding empathy (a quality consistently on display in all of Rushkoff’s work) with the protesters. But when the rocks started flying and bus windows started breaking, it changed. He knew people on that bus, and he had concerns for them, as well. They were largely already “stressed-out, perpetually monitored, and painfully aware of their own perishability” in a company like Google. He continues:

“Sprints”—bursts of round-the-clock coding to meet deadlines—came ever more frequently as new, more ambitious growth targets replaced the last set. … Google workers are less the beneficiaries of an expanding company than they are its rapidly consumed resources. The average employee leaves within a year—some to accept better positions at other companies, but most of them simply to break free of the constant pressure to perform. … They are human beings.

It is also true that, while the rapid gentrification of one American city’s neighborhoods, the result of its proximity to the engines of the new digital economy, while perhaps a great encapsulation of the havoc that economy is wreaking on the lives of human beings, is but a microcosm of it. It is also not exactly constructive to blame fellow human beings who, even if more handsomely compensated that most around them, are still just trying to make a living in an economic reality that’s been completely upended from the one we grew up with.

The real problem, Douglas Rushkoff suggests, is more systemic:

But there’s no easy place to draw the battle lines or enemy at whom to hurl the rocks. That’s because the conflict here is not really between San Francisco residents and Google employees or the 99 percent and the 1 percent. It’s not even stressed-out employees against the companies they work for or the unemployed against Wall Street so much as everyone—humanity itself—against a program that promotes growth above all else.

This new book is in some ways a continuation/combination of two separate strains of Rushkoff’s work, evident in two previous (great) books of his, Life Inc. and Program or Be Programmed. Here he sees an unwelcoming, almost apocalyptic endgame to satiate the current economic paradigm’s appetite for endless growth, and asks us to make a choice.

We need to make a choice. We can continue to run this growth-driven, extractive, self-defeating program until one corporation is left standing and the impoverished revolt. Or we can seize the opportunity to reprogram our economy—and our businesses—from the inside out.

Even the most celebrated Internet companies and apps (Google, Facebook, Twitter, Uber, etc.) have two fatal flaws: a steady decline in profit over net worth, and a lack of creating real value for society. When they do create revenue, their valuations are still grossly unrelated to any actual revenue they produce, and the revenues they do produce are largely created in ways most of us find uncomfortable or unpalatable. For example:

Users are slowly coming to grips with the fact that they are not Facebook’s customers, but its product.

These shiny new digital behemoths may be disrupting and tearing down old, dirty industrial ones, but that doesn’t make them any better for people than those industrial predecessors. They still have to be fed with our labor, whether it’s spending time scanning and liking things on a social media, providing valuable data to be sold to third party marketing firms, or driving strangers around in our cars and hosting them in our homes to make rent. In fact, instead of freeing up our time, they demand more of it. Most make us more distracted at work, and those that do lead to increased worker efficiency lead to more workers being laid off and ultimately replaced.

Rather than rewarding those that create value, the system is designed to reward those that extract it. And that is because, for as much as the Silicon Valley set talks about “disruption,” most entrepreneurs are more than willing—even motivated by the primary goal—to sell their companies to the highest bidder. Even if they remain in a leadership role, the role of the company is altered forever. Speaking of seeing Blogger founder and Twitter CEO Evan Williams on the cover of the Wall Street Journal, Douglas writes of his conflicting feelings:

Evan had disrupted journalism with the blog, and newgathering with the tweet, but now he was surrendering all that disruption to the biggest, baddest industry of them all. When you’re on the cover of the Wall Street Journal receiving applause from all those guys in suits, its not usually because you’ve done something revolutionary; it’s because you have helped confirm financial capital’s centrality to the whole scheme of human affairs.

And, of course, since the IPO, Twitter’s game has changed. They seem to have hit a ceiling of users since then, but instead of accepting that as a potential reality and working to refine and improve the service to meet the wants and needs of those dedicated to the platform, there is a general panic about the lack of growth, what that means for their future, and a call to extract whatever value they can from the users they have:

Shareholders are demanding Twitter find better ways of monetizing its users tweets, whether by injecting advertisements into people’s feeds, mining their data for marketing intelligence, or otherwise degrading the utility of the app or the integrity of its community. Whatever actually may have been disruptive about Twitter will now have to be made less so.

This is not a result of a poorly executed strategy, or the result of a fundamental flaw in the service. It’s an indictment of a the whole economic model—the startup to IPO, literally “selling-out” in old indie parlance—that Silicon Valley and the technology industry is currently built upon. Put in plain and straightforward Rushkoffian parlance:

That’s the game most of us now call the digital economy. It is accepted unquestioningly, because it stokes the flames of growth—however artificially. Companies are free to disrupt almost any industry they choose—journalism, television, music, manufacturing—so long as they don’t disrupt the financial operating system churning beneath it all. Hell, most of the founders of these digital companies don’t seem to realize this operating system even exists. They are happy to challenge one “vertical” or another, but the last thing they do when they’ve got a winner in challenge the rules of investment banking, their own astronomical valuation, or the IPO through which they cash out.

Other than a few companies, the new economy isn’t doing anything to help us as creators or consumers. We’re mostly unpaid for the work we do, and the so-called “long tail” of the Internet never grew. It has turned into a winner-take-all disparity for both the platforms and creators of culture. Rushkoff does provide some promising examples of companies building services that are tailored to their users and supportive of a different, less algorithmic, more humane economic paradigm (Bandcamp to contrast Spotify, for instance, and Sidecar to contrast Uber). He also provides some public policy prescriptions for what ails us in terms of unemployment and underemployment. But the policy ideas he puts forward assume we have a functioning congress to agree on and pass such prescriptions, which seems far-fetched at the moment. Which is why he ends the chapter by writing “That’s why we have to look at what we can do as business owners, investors, bankers, and individuals to program an economic operating system that works for people instead of against them.” And it is there he gives us ways we can move forward in our own businesses.

Along the way, you’ll learn how the current system is tied to renaissance aristocracy, national currencies, the chartered corporation and the industrial revolution, and how two separate popes around the turn of the last century outlined a return to pre-feudal business realities and scale that Rushkoff would like us to borrow from today.

This leads to Rushkoff’s ultimate conclusion that just as the artisanal economy gave way to the industrial—which has held sway since 1300—we must now consciously transition to a system of digital distributism that retrieves or more closely mirrors the fundamental human values of a pre-industrial economy. He admits it will be an ad-hoc and evolving system, but he gives us a lot of great ideas to get there. I’ll invite you to read and discover the solutions that best fit you and your organization but suffice it to say, it does not involve throwing rocks at the Google bus.